This Classic Economic Gauge Just Flashed A Crisis-Stage Signal

BY Benzinga | ECONOMIC | 08/28/25 03:12 PM EDTA classic economic indicator just nosedived to levels not seen since the depths of the 2020 pandemic, flashing bright-red signals about global growth fears.

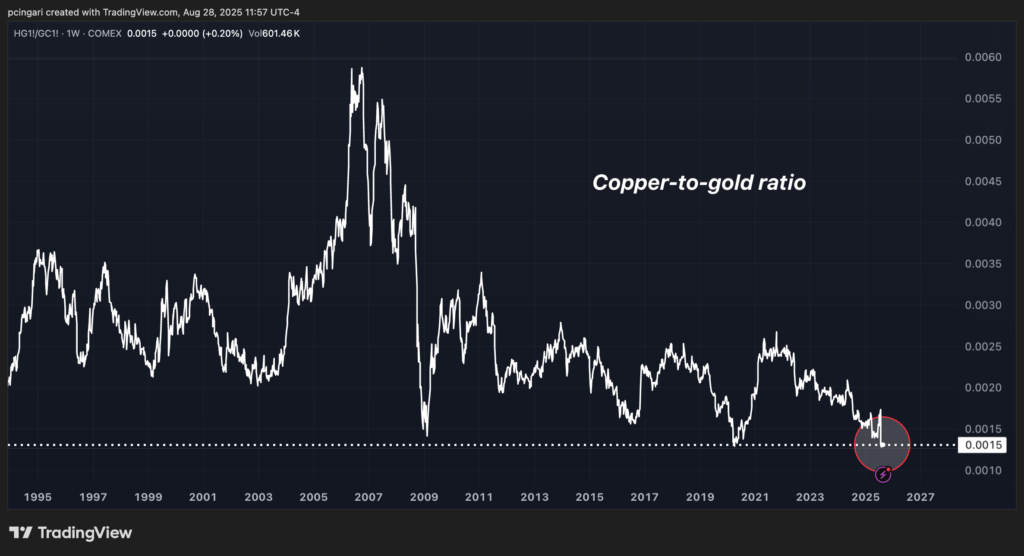

The copper-to-gold ratio ? a widely watched gauge of global economic sentiment ? has plunged to 0.0015, its lowest reading since March 2020. This sharp decline suggests investors are losing confidence in the strength of the economic recovery.

Why Does The Copper-To-Gold Ratio Matter?

This ratio tracks how many pounds of copper you can get for one ounce of gold.

Copper shines when the economy is expanding. It's used in everything from homes to electronics to infrastructure. Gold, on the other hand, thrives when investors seek safety ? typically during economic downturns or geopolitical stress.

Because copper is a bellwether for industrial activity and gold thrives in uncertain environments, a drop in the ratio often implies a loss of confidence in economic momentum.

When the copper-to-gold ratio falls, it means that gold is outperforming copper ? a clear "risk-off" signal. It tends to precede or coincide with major slowdowns.

The last time this ratio hit such low levels was in early 2020, right as COVID-19 threw the global economy into recession. Before that, such depressed readings were only seen during the 2008 financial crisis.

What Caused The Crash In Copper?

Although copper has climbed 13% in the first half of 2025, volatility erupted quickly after President Donald Trump announced a 50% tariff on imported copper in July.

Prices initially soared on fears of supply disruptions, hitting record highs. But on July 31, Trump clarified that refined copper would be exempt ? sparking a jaw-dropping 22% collapse in a single day.

That was the worst single-day loss for copper ever, more than twice the biggest daily decline suffered during the Great Financial Crisis.

By late August, copper prices were still struggling to recover, holding at $4.52 per pound ? a level that reflects ongoing uncertainty around trade policy and industrial demand.

Meanwhile, gold ? as tracked by the SPDR Gold Trust ? is having a blockbuster year, outperforming all other major assets.

Prices have surged 30% year-to-date, with the yellow metal trading near $3,400 per ounce ? just 2% off April's record high of $3,500.

<figure class="wp-block-image size-large"> </figure>

</figure>

Gold's Bull Run Isn't Over, Says Expert

Marcus Garvey, head of commodities strategy at Macquarie, said gold has been remarkably resilient despite not breaking higher over the summer.

Garvey said the political backdrop ? especially questions around Federal Reserve independence under the Trump administration ? remains a key catalyst for gold.

"If Governor Cook were to leave and Trump were to gain control over key Fed appointments, then the market needs to put a much different risk premium into gold," he said.

"That would be an extremely bullish development."

Even if U.S. equities continue climbing, Garvey believes gold can rise in tandem ? especially if monetary policy becomes too loose relative to inflation risks.

"If stocks are rallying because of excessive Fed easing, and that easing stokes long-term inflation expectations, then gold can absolutely rally alongside equities."

Read Next:

- Something Big Is Brewing In Gold, Stocks, And The Dollar: JPMorgan’s Half-Year 2025 Outlook

Image created using artificial intelligence via Midjourney.

Print

Print