Newmont (NEM) Stock Slides As Warsh Fed Pick Triggers Sharp Gold Selloff

BY Benzinga | ECONOMIC | 01/30/26 12:25 PM ESTNewmont Corporation

Gold, tracked by SPDR Gold Trust , is trading over 6% lower Friday morning. Here’s what investors need to know.

- Newmont

(NEM) stock is feeling bearish pressure. What’s pressuring NEM stock?

Warsh’s Nomination Could Shift Fed Policy Landscape

Warsh is widely viewed as more skeptical of ultra-easy monetary policy than current chair Jerome Powell. As a former Fed governor and key player during the 2008 crisis, he has criticized prolonged near-zero rates and large-scale asset purchases.

Markets interpret his nomination as a signal that the Fed could keep real interest rates higher for longer and be slower to cut aggressively in future downturns.

To many on Wall Street, Warsh’s track record potentially signals a Fed that is less likely to slash interest rates aggressively, helping to calm recent worries that political pressure could erode the central bank's independence.

For Newmont

Because miners' profits are leveraged to bullion prices, a mid-single-digit decline in gold can translate into much larger percentage moves in earnings and equity valuations.

What NEM Investors Should Watch Next

Holders of NEM should monitor Fed commentary from Warsh, the path of the dollar index and whether gold stabilizes after Friday's rout, as these factors are likely to drive the stock's next move.

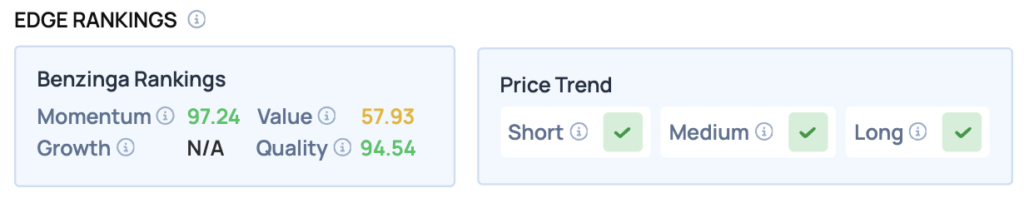

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Newmont

- Quality: Strong (Score: 94.54) ? The company maintains a healthy balance sheet.

- Momentum: Bullish (Score: 97.24) ? Stock is outperforming the broader market.

- Value: Neutral (Score: 57.93) ? Trading at a fair valuation relative to peers.

The Verdict: Newmont’s Benzinga Edge signal reveals a strong momentum score, indicating that the stock is currently outperforming the broader market. However, the neutral value score suggests that while the stock is performing well, it is not significantly undervalued, which may warrant caution for new investors.

<figure class="wp-block-image size-large"> </figure>

</figure>

NEM Shares Slide Friday

NEM Price Action: Newmont

Image: Shutterstock

Print

Print