Top Wall Street Forecasters Revamp Charter Communications Expectations Ahead Of Q4 Earnings

BY Benzinga | CORPORATE | 01/30/26 03:44 AM ESTCharter Communications, Inc

Analysts expect the company to report fourth-quarter earnings of $9.88 per share. That's down from $10.1 per share in the year-ago period. The consensus estimate for Charter Communications'

On Jan. 13, Charter Communications

Shares of Charter Communications

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

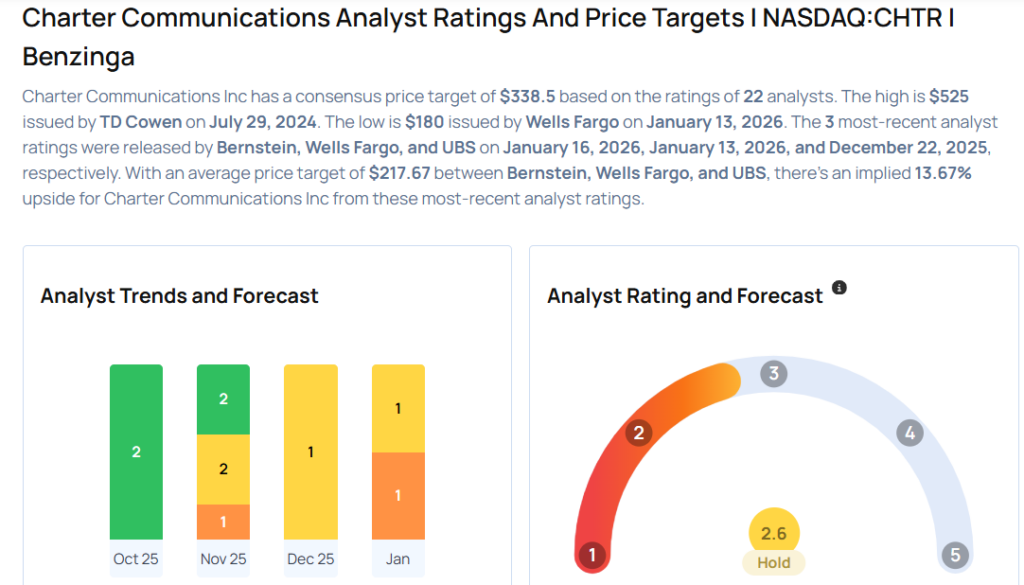

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wells Fargo analyst Steven Cahall downgraded the stock from Equal-Weight to Underweight and cut the price target from $240 to $180 on Jan. 13, 2026. This analyst has an accuracy rate of 66%.

- UBS analyst John Hodulik maintained a Neutral rating and slashed the price target from $355 to $233 on Dec. 22, 2025. This analyst has an accuracy rate of 75%.

- Citigroup analyst Michael Rollins maintained a Buy rating and cut the price target from $325 to $310 on Nov. 3, 2025. This analyst has an accuracy rate of 73%.

- RBC Capital analyst Jonathan Atkin maintained a Sector Perform rating and lowered the price target from $325 to $265 on Nov. 3, 2025. This analyst has an accuracy rate of 53%.

- Barclays analyst Kanan Venkateshwar maintained an Underweight rating and cut the price target from $275 to $200 on Nov. 3, 2025. This analyst has an accuracy rate of 55%

Considering buying CHTR stock? Here’s what analysts think:

<figure class="wp-block-image size-large is-resized"> </figure>

</figure>

Photo via Shutterstock

Print

Print