SoundHound AI (SOUN) Stock Tumbles 40% In A Month Despite Earnings Beat, CEO Optimism

BY Benzinga | ECONOMIC | 11/18/25 12:01 PM ESTSoundHound AI Inc

Hawkish comments from Federal Reserve officials have slashed hopes for a December rate cut, reigniting a tech sector selloff that is punishing speculative AI assets regardless of operational performance. Here’s what investors need to know.

- SOUN is having a challenging session. Get the inside scoop here.

What To Know: The continued volatility follows the company’s third-quarter earnings report released earlier this month. Despite posting record revenue of $42.05 million, a 68% year-over-year surge that beat analyst estimates, and matching adjusted EPS expectations with a 3-cent loss, the market reaction has been decidedly bearish.

Management remains outwardly aggressive. CEO Kevan Mohajer recently asserted that SoundHound's technology now outperforms “Big Tech” rivals by up to 40% in accuracy and highlighted a new “eight-figure” robotics contract in China. The company also raised its full-year 2025 revenue guidance to a range of $165 million to $180 million.

However, the disconnect between these ambitious operational milestones and the stock’s immediate performance suggests investors are reassessing the premium valuation of this voice-AI player amid a broader “sell the news” sentiment.

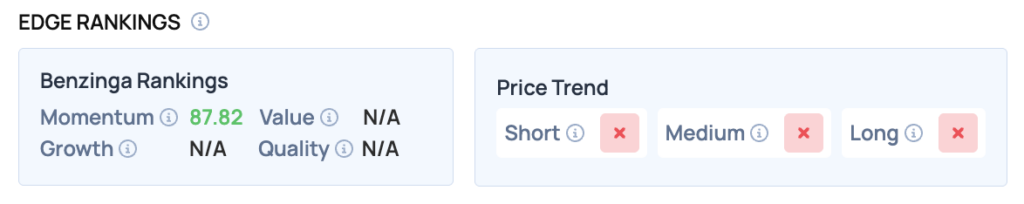

Benzinga Edge Rankings: Benzinga Edge stock rankings underscore this volatility, assigning SoundHound a high Momentum score of 87.82 even as price trends across short, medium and long-term horizons remain negative.

<figure class="wp-block-image size-large"> </figure>

</figure>

SOUN Price Action: SoundHound AI

Read Also: Everyone’s Bullish, Cash Is Gone?What Happens If The Fed Doesn’t Cut?

How To Buy SOUN Stock

By now you're likely curious about how to participate in the market for SoundHound AI

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

Print

Print