Bloom Energy Stock Is Getting Hammered Thursday: What's Going On?

BY Benzinga | CORPORATE | 11/13/25 03:12 PM ESTBloom Energy Corp

The pullback comes as risk sentiment weakens on Wall Street following cautious comments from Federal Reserve officials and renewed worries about the economic outlook.

- BE is among today’s weakest performers. Get the complete picture here.

What To Know: The stock had ripped higher in late October after Bloom reported blockbuster third-quarter results, highlighted by revenue of about $519 million and roughly 57% year-over-year growth.

Earnings topped expectations, and management pointed to "powerful tailwinds" from surging electricity demand tied to artificial intelligence and new data-center partnerships. Several analysts responded by reiterating bullish ratings and sharply raising price targets.

Momentum extended into early November as Bloom upsized a private offering of zero-coupon convertible senior notes due 2030 to roughly $2.5 billion and launched concurrent exchanges of existing 2028 and 2029 notes for cash and stock. With net proceeds earmarked for refinancing and growth investments, investors had largely cheered the move.

Thursday’s decline likely reflects profit-taking after year-to-date gains of over 300% and a broader rotation out of higher-beta names, rather than any new company-specific negative catalyst for Bloom Energy

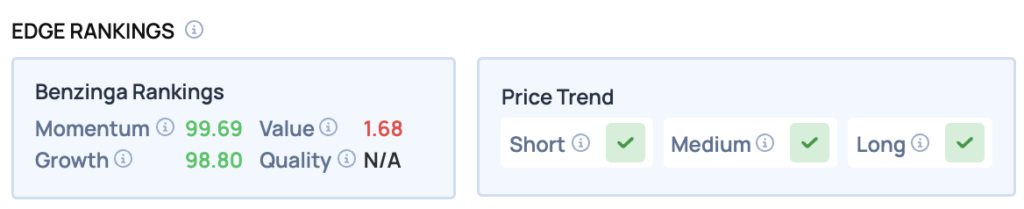

Benzinga Edge Rankings: According to Benzinga Edge rankings, Bloom Energy

</figure>

</figure>

BE Price Action: Bloom Energy

Read Also: Tradr Expands Leveraged Lineup With 4 New Single-Stock ETFs Targeting AI Infrastructure Firms

How To Buy BE Stock

By now you're likely curious about how to participate in the market for Bloom Energy

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Bloom Energy

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

Print

Print