Meta, Alphabet, Chipotle, Microsoft And Starbucks: Why These 5 Stocks Are On Investors' Radars Today

BY Benzinga | ECONOMIC | 10/29/25 10:31 PM EDTMajor stock indexes traded mixed on Wednesday, with the Dow Jones Industrial Average slipping nearly 0.2% to 47,632 and the S&P 500 holding steady at 6,890.59, while the Nasdaq gained 0.55% to 23,958.47.

The Federal Reserve cut its benchmark interest rate by 25 basis points to 3.75%-4.00% and announced it would halt the runoff of its securities holdings starting Dec. 1, ending its quantitative tightening program. The decision, which saw two dissenting votes, reflected the Fed's cautious approach amid slowing job growth, moderate economic expansion, and lingering inflation pressures.

These are the top stocks that gained the attention of retail traders and investors throughout the day:

Meta Platforms Inc. (META) ?

Meta saw a slight increase of 0.03% in its stock, closing at $751.67. The stock hit an intraday high of $759.16 and a low of $742.51, with a 52-week range of $796.25 to $479.80. In the after-hours trading, the stock dropped by over 7% to $696.30.

The company’s?third-quarter earnings?included a one-time, non-cash income tax charge of $15.93 billion. Meta Platforms

Alphabet Inc. (GOOG) ?

Alphabet Class C shares experienced a 2.51% increase, closing at $275.17. The stock reached an intraday high of $275.97 and a low of $268.43, with a 52-week range of $275.97 to $142.66. In the after-hours session the Class C shares rose 6.73% to $293.69.

The company’s Class A stock gained 2.65% for the day at $274.57. GOOGL gained 6.72% in the after-hours trading and rose to $293.01.

Alphabet reported third-quarter revenue of $102.35 billion, up 16% year-over-year and above estimates, with earnings of $2.87 per share. Growth was fueled by gains across Search, YouTube

Chipotle Mexican Grill Inc. (CMG) ?

Chipotle saw a decrease of 1.24% in its stock, closing at $39.76. The stock hit an intraday high of $40.65 and a low of $39.59, with a 52-week range of $66.74 to $38.30. In the after-hours trading, the stock fell 16.5% to $33.19.

Chipotle reported third-quarter earnings of $0.29 per share, matching estimates, while revenue of $3 billion slightly missed expectations of $3.02 billion. Comparable restaurant sales and margins declined modestly, and the company opened 84 new locations.

Microsoft Corporation (MSFT) ?

Microsoft

Microsoft

Starbucks Corporation (SBUX) ?

Starbucks

Starbucks

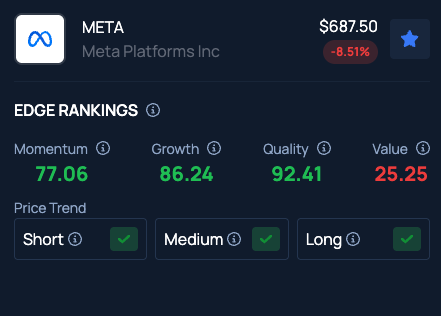

Benzinga's Edge Stock Rankings indicate Meta stock has a value in the 25th percentile. Here is how the stock is placed among other tech bigwigs.

<figure class="wp-block-image size-full"> </figure>

</figure>

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Photo Courtesy: MMD Creative on Shutterstock.com

Read Next:?

Peter Schiff: Bitcoin Depends On ‘Growing Supply Of Fools’?And Technical Analysis Says He’s Not Wrong

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Print

Print