NXP Semiconductors Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

BY Benzinga | CORPORATE | 10/27/25 10:29 AM EDTNXP Semiconductors N.V.

Analysts expect the Eindhoven, the Netherlands-based company to report quarterly earnings at $3.12 per share, down from $3.45 per share in the year-ago period. The consensus estimate for NXP Semiconductors'

On Aug. 12, NXP Semiconductors

NXP Semiconductors

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Harlan Sur maintained a Neutral rating and raised the price target from $205 to $240 on July 23, 2025. This analyst has an accuracy rate of 81%.

- Truist Securities analyst William Stein maintained a Buy rating and increased the price target from $230 to $252 on July 23, 2025. This analyst has an accuracy rate of 86%.

- Susquehanna analyst Christopher Rolland maintained a Neutral rating and boosted the price target from $195 to $210 on July 23, 2025. This analyst has an accuracy rate of 77%.

- Barclays analyst Tom O'Mailey maintained an Overweight rating and raised the price target from $190 to $220 on July 22, 2025. This analyst has an accuracy rate of 77%.

- Needham analyst Quinn Bolton maintained a Buy rating and raised the price target from $225 to $250 on July 22, 2025. This analyst has an accuracy rate of 84%.

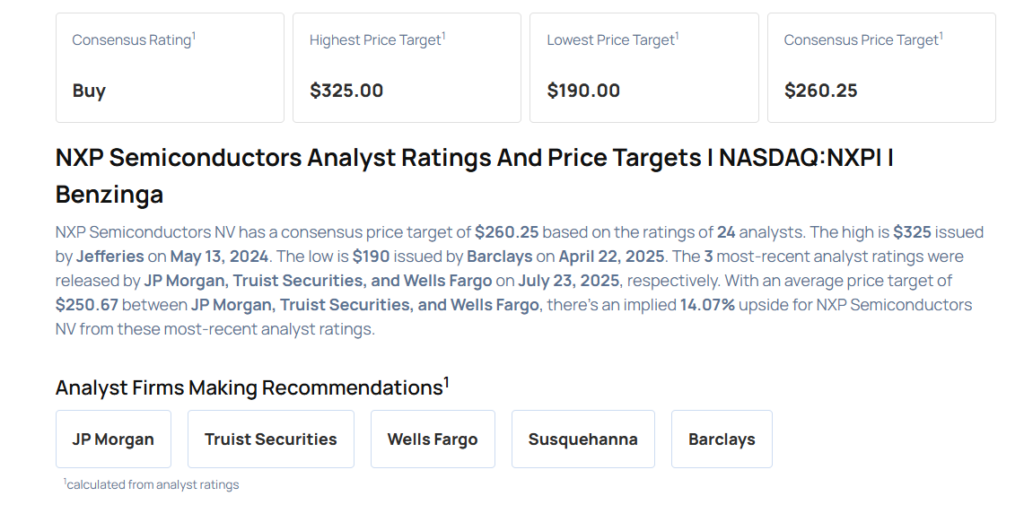

Considering buying NXPI stock? Here’s what analysts think:

<figure class="wp-block-image size-large is-resized"> </figure>

</figure>

Read This Next:

- Top 3 Real Estate Stocks That May Explode In Q4

Photo via Shutterstock

Print

Print