Options Corner: A High-Stakes Sentiment Battle Could Send SoundHound AI Ripping Higher

BY Benzinga | ECONOMIC | 09/18/25 03:35 PM EDTWhile the Federal Reserve made waves yesterday for finally cutting the benchmark interest rate by 25 basis points, many experts are worried about potential stagflation risks. However, the technology ecosystem has apparently not received the memo, with individual players like SoundHound AI Inc

To be sure, it's reasonable to believe that most of the optimism has already been baked in. Therefore, betting on SOUN stock now might risk a painful bag-holding experience. For example, on Thursday afternoon, SOUN gained roughly 6%. This sizable jump brought the security's trailing five-day return to nearly 11%. Compounding matters is that in the trailing half-year period, SOUN swung up around 67%.

Despite the impressive print, SOUN stock may have more to give.

Part of the bullish narrative stems from sustained interest in the tech space. Just recently, Nvidia Corp

Further, technical indicators have flashed that suggest that momentum is building for SOUN stock. Specifically, following a temporary pullback, SOUN found support at the 50-day moving average. Plus, other signals ? such as the Relative Strength Index (RSI) ? imply that the bulls have gained control of the market.

Still, the most convincing argument (in my opinion) is that these fundamental and technical catalysts are flashing amid an apparent rise in short interest. Thus, it appears that we have a winner-takes-all battle on our hands.

SOUN Stock Offers Another Compelling Contrarian Opportunity

Yesterday, I noted that cryptocurrency miner CleanSpark Inc

At time of writing, CLSK stock has gained roughly 18%. I badly underestimated the psychological pull involved. However, I remain bullish on CleanSpark

Just to quickly recap, a true short position is a credit-based transaction where the bearish speculator underwrites the risk that the targeted security will not rise in value but instead fall. If it does, the short trader can then buy back the securities that were initially borrowed on credit to initiate the short position.

That's all fine and well unless the stock rises in value. At that point, instead of pocketing the difference as profit, the speculator ends up paying the difference as an obligation. Where a short squeeze comes into play is the panic among bears to extricate their short exposure. Basically, a short position can only be exited by buying to close.

Legally, the lending broker of the securities must be made whole. So, irrespective of whatever happens to the stock, short traders must return the borrowed securities. That's why short squeezes are really messy ? but they can be very lucrative for contrarian bulls.

<figure class="wp-block-image size-large"> <figcaption class="wp-element-caption">Image by author</figcaption></figure>

<figcaption class="wp-element-caption">Image by author</figcaption></figure>

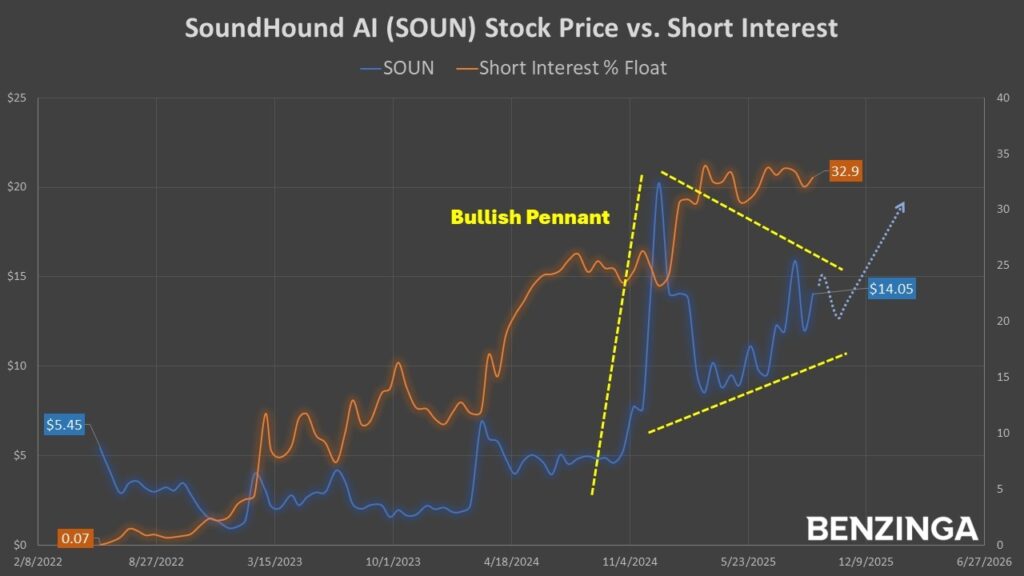

With SOUN stock, its short interest has jumped to 32.2% of its float, making it one of the most shorted stocks on Wall Street. Interestingly, the correlation coefficient between SOUN's price action and its short interest stands at 73.23%. In other words, as short interest marched higher in stepwise fashion, SoundHound's security has also moved northward.

Now, I'm not suggesting that one is causing the other to move up. Interestingly, though, in the midst of the bearish activity against SoundHound, SOUN stock appears to be printing a bullish pennant formation ? the same chart pattern that CLSK flashed.

Keeping It Simple

Given the explosiveness that we saw in the cryptocurrency miner, I think a simple, uncapped strategy may be the most effective. To get exposed to the name, I wouldn't at all be against buying SOUN stock in the open market right now. As public traders on popular securities have demonstrated time and again, you do not want to bet against this freight train.

Next, I would consider a straightforward longer-expiry naked debit strategy. One idea to consider is the $16 call expiring April 17, 2026. At time of writing, the ask on this option is $4.45, meaning that SOUN stock will need to reach $20.45 (based purely on intrinsic value) to break even. That's very aggressive but also rational based on trends we've seen in prior short-squeeze prospects.

As for those who really prefer the capped-risk, capped-reward nature of vertical spreads, one possible idea is to look at the 16/17 bull call spread expiring Oct. 17. A transaction involving the simultaneous purchase of the $16 call and sale of the $17 call, the net debit comes in at $36 (the most that can be lost). Should SOUN stock hit $17 at expiration, the maximum profit is $64, a nearly 178% payout.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

- Options Corner: CleanSpark Could Offer Crypto Speculators A Massive Short Squeeze

Image: Shutterstock

Print

Print