D-Wave Quantum (QBTS) Stock Hit A New All-Time High Today: What's Going On?

BY Benzinga | ECONOMIC | 09/18/25 12:37 PM EDTShares of D-Wave Quantum Inc

What To Know: Wednesday’s Federal Reserve interest rate cut has created a more bullish environment for tech stocks, providing a broad lift to the sector. Signaling a potentially faster pace of future easing, the Fed announced its fourth consecutive interest rate cut, trimming its benchmark rate by 25 basis points to a new range of 4%-4.25%.

D-Wave on Wednesday also showcased impressive growth in the Asia Pacific region, with bookings soaring by 83% over the past year. Highlighting this success, D-Wave announced a pilot program with Japan Tobacco for quantum AI drug discovery.

Another key development is a project with NTT DOCOMO that has already cut mobile network congestion by 15% using D-Wave’s quantum computing solutions. These advancements have investors optimistic about D-Wave’s expanding footprint in the global quantum computing market.

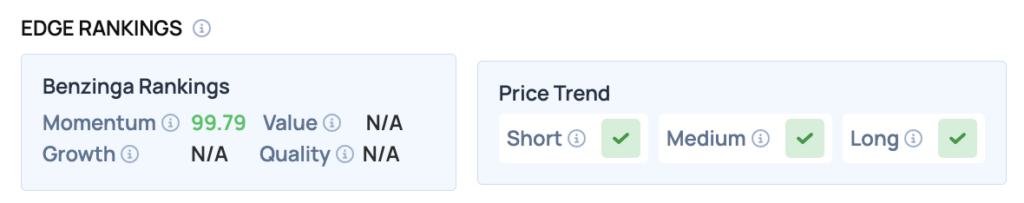

Benzinga Edge Rankings: Underscoring this bullish activity, the stock has earned a Benzinga Edge Momentum score of 99.79, reflecting its exceptionally strong recent price performance.

<figure class="wp-block-image size-large"> </figure>

</figure>

Price Action: According to data from?Benzinga Pro, QBTS shares are trading higher by 5.75% to $23.84 Thursday morning. The stock has a 52-week high of $23.41 and a 52-week low of $0.87.

Read Also: Novo Nordisk’s Wegovy Outperforms Eli Lilly’s Tirzepatide In Reducing Risk Of Heart Attack, Stroke, And Death: Study

How To Buy QBTS Stock

By now you're likely curious about how to participate in the market for D-Wave Quantum

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of D-Wave Quantum

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

Print

Print