Robinhood Stock Falls As Dismal Jobs Report Sparks Financial Sector Sell-Off

BY Benzinga | ECONOMIC | 09/05/25 03:21 PM EDTRobinhood Markets Inc

What To Know: The U.S. economy added a meager 22,000 nonfarm payrolls last month, falling dramatically short of expectations and marking the slowest pace of hiring since 2020. The report also included downward revisions for June and July, signaling a rapidly cooling labor market.

In response, cyclical sectors such as financials came under significant pressure. While the poor data solidifies expectations for Federal Reserve interest rate cuts later this month, fears that a slowing economy could reduce trading activity and investor engagement are weighing heavily on sentiment for brokerage platforms like Robinhood.

The broader S&P 500 and Dow Jones also pulled back from record highs amid the economic jitters, reflecting widespread market weakness late Friday.

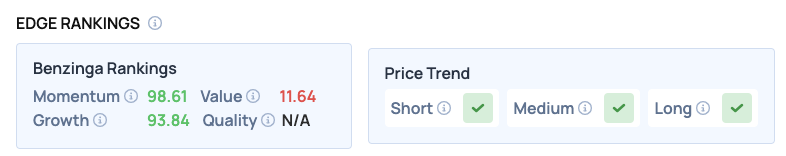

Benzinga Edge Rankings: Despite the day’s decline, Benzinga Edge stock rankings indicate Robinhood has an exceptionally high momentum score of 98.61.

<figure class="wp-block-image size-full"> </figure>

</figure>

HOOD Price Action: According to data from?Benzinga Pro, Robinhood shares are trading lower by 2.07% to $100.78 on Friday afternoon. The stock has a 52-week high of $117.70 and a 52-week low of $18.71.

How To Buy HOOD Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For Robinhood Markets

Read Also:

? LoanDepot Stock Is Surging Friday: What’s Driving The Action?

Image: Shutterstock

Print

Print