Gold Touches New All-Time High Amid Rising Central Bank Demand, Escalating Trump-Federal Reserve Tensions

BY Benzinga | ECONOMIC | 09/03/25 01:36 AM EDTSpot gold prices touched a new all-time high on Tuesday, at $3,546.99 per ounce, surging past its prior record high of $3,500 in April this year. Other precious metals such as silver and platinum have surged in recent weeks, trading at $40.72 and $1,397 per ounce, respectively.

GLD stock is at important technical levels. See if it is worth your attention here.

Central Bank Demand And Fed Tensions

Earlier this week, it was reported that for the first time in nearly three decades, Central Banks worldwide own more gold than U.S. Treasuries. This move is being viewed as part of a broader trend toward diversification among the world’s central banks.

Growing geopolitical uncertainties, alongside the desire to reduce reliance on the U.S. Dollar, are being seen as key drivers behind this shift.

According to risk analyst and Black Swan author Nassim Nicholas Taleb, “the dollar lost 40% of its value in terms of gold” over the past two years alone.

He also notes that the actions of President Donald Trump, specifically his trade and tariff policies, as well as his escalating tensions with the Federal Reserve, are “exacerbating” this decline.

The rush to gold in recent weeks was sparked by Trump’s attempted dismissal of Federal Reserve Governor Lisa Cook, raising concerns of political interference in U.S. monetary policy.

According to Craig Shapiro, Macro Strategist at The Bear Traps Report, Trump’s dismissal of Cook could hand him a rare majority in the Federal Open Markets Committee, allowing him to appoint two governors, resulting in a 4-3 majority on the board. Following the end of Jerome Powell’s term in 2026, he says, this majority can reach 5-2.

Precious Metals Shine Amid Uncertainties

Growing uncertainties have led several other precious metals, alongside gold, to shine this year, with many seeing significant spikes over the past few weeks alone.

<figure class="wp-block-table">| Commodity / ETF | Year-To-Date Performance | 1 Month Performance |

| Gold | +33.04% | +4.79% |

| Silver | +37.86% | +9.91% |

| Platinum | +57.03% | +6.92% |

| SPDR Gold Trust | +32.67% | +5.33% |

| iShares Silver Trust | +37.95% | +10.59% |

| Sprott Physical Platinum And Palladium Trust | +37.33% | +2.48% |

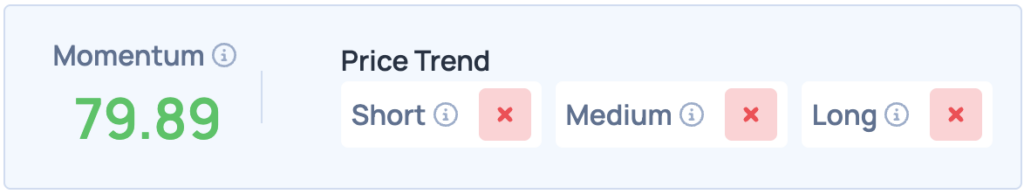

According to Benzinga’s Edge Stock Rankings, the SPDR Gold Trust scores high on Momentum, but fares poorly with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the fund.

<figure class="wp-block-image aligncenter size-large is-resized"> </figure>

</figure>

Read Next:

- Scott Bessent Says Trump Tariffs Delivering ‘Historic Results,’ GDP Growth Could Hit 5% ? Justin Wolfers Hits Back: ‘Ask American Manufacturers’

Photo Courtesy: Hodoimg on Shutterstock.com

Print

Print