Circle Internet Group Stock Is Sliding Tuesday: What's Going On?

BY Benzinga | TREASURY | 09/02/25 03:55 PM EDTCircle Internet Group Inc

See how CRCL stock is doing here.

What To Know: The sell-off in growth stocks comes as the yield on the 10-year U.S. Treasury note climbed, signaling investor concern about persistent inflation and the potential for the Federal Reserve to maintain a hawkish monetary policy. Higher interest rates are particularly detrimental to growth-oriented companies such as Circle Internet

The valuations of growth stocks are heavily based on the present value of their expected future earnings. When Treasury yields rise, the discount rate used to calculate the present value of these future cash flows also increases.

Read Also: What’s Going On With Nvidia Stock?

This higher discount rate reduces the current worth of those anticipated profits, making the stock appear less attractive and putting downward pressure on its price.

Many growth companies, especially in the technology sector, rely on debt to finance their expansion and innovation. Rising Treasury yields translate into higher borrowing costs for these firms. This can squeeze profit margins, hinder investment in future projects and ultimately slow down the very growth that investors are banking on.

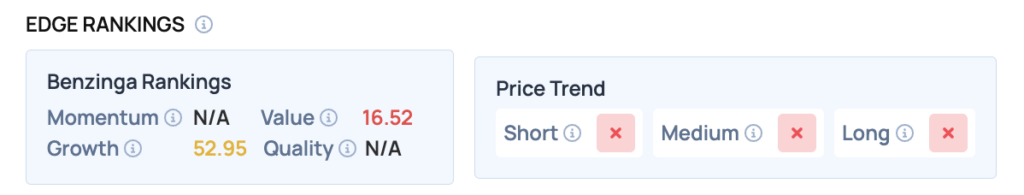

Benzinga Edge Rankings: Benzinga Edge ranks Circle Internet’s value at 16.52, indicating a relatively low value score.

<figure class="wp-block-image size-large"> </figure>

</figure>

CRCL Price Action: According to data from Benzinga Pro, Circle Internet

Read Also: VIX Jumps 20% As Stocks Slump, Gold Tops Record Highs: What’s Moving Markets Tuesday?

How To Buy CRCL Stock

Besides going to a brokerage platform to purchase a share ? or fractional share ? of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For Circle Internet

Image: Shutterstock

Print

Print