CoreWeave Stock Is Getting Hammered Tuesday: What's Going On?

BY Benzinga | TREASURY | 09/02/25 01:40 PM EDTShares of AI infrastructure provider CoreWeave Inc

What To Know: The pressure appears linked to rising long-term interest rates, with the 10-year Treasury yield climbing to 4.29%, making future earnings for high-P/E companies seem less attractive to investors.

Higher, safer returns on government bonds increase the discount rate used in financial models to determine the present value of a company’s future earnings. For a high-growth firm like CoreWeave

What Else: The session’s decline Tuesday contrasts sharply with a flurry of positive news for the company in late August. The company's backlog has surged to $30.1 billion, with contracts from OpenAI accounting for nearly half of that figure.

CoreWeave

However, the positive operational news is currently being overshadowed by macroeconomic headwinds. The downturn also follows a period of insider selling after a mid-August lock-up expiration, even as institutional investors like Jane Street took new positions.

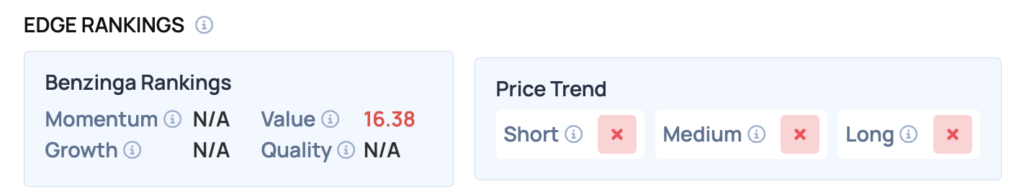

Benzinga Edge Rankings: Highlighting a potential valuation concern, Benzinga Edge Rankings give the stock a low Value score of 16.38.

<figure class="wp-block-image size-large"> </figure>

</figure>

Price Action: According to data from?Benzinga Pro, CRWV shares are trading lower by 10.33% to $92.46 Tuesday. The stock has a 52-week high of $187.00 and a 52-week low of $33.52.

Read Also: What’s Going On With Nvidia Stock?

How To Buy CRWV Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in CoreWeave’s case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock

Print

Print