Opendoor (OPEN) Shares Rebound In Volatile Week: What's Going On?

BY Benzinga | ECONOMIC | 08/28/25 01:47 PM EDTShares of Opendoor Technologies Inc

What To Know: The stock is once again testing a critical technical barrier that has halted prior rallies. The volatile week began with a surge for Opendoor

For Opendoor

However, the rally hit a wall on Wednesday as the stock price approached the $4.85 level. This price has proven to be a point of resistance, marking the peak of at least four major rallies since mid-2023. Each time, the stock has met with significant selling pressure.

<figure class="wp-block-image size-large"> </figure>

</figure>

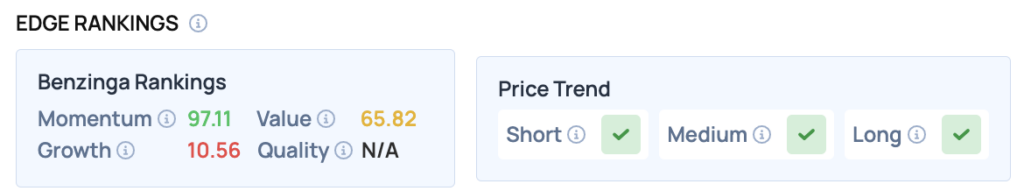

Price Action: According to data from?Benzinga Pro, Opendoor

Read Also: CoreWeave Stock Surges As Nvidia’s AI Revenue Fires Up

How To Buy OPEN Stock

By now you're likely curious about how to participate in the market for Opendoor

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

Print

Print