Amazon Shares Pop As Powell Signals Looming Rate Cuts Amid Cooling Labor Market

BY Benzinga | ECONOMIC | 08/22/25 03:34 PM EDTAmazon.com Inc

What To Know: For growth companies like Amazon

Higher borrowing costs have weighed on both Amazon's

At the same time, Amazon's

Powell also downplayed inflation risks from tariffs, calling the impact a "one-time shift in the price level." That gives further room for accommodating policy, a boon for consumer spending. With household budgets under strain, cheaper credit could support e-commerce demand heading into the holiday season, directly benefiting Amazon's

</figure>

</figure>

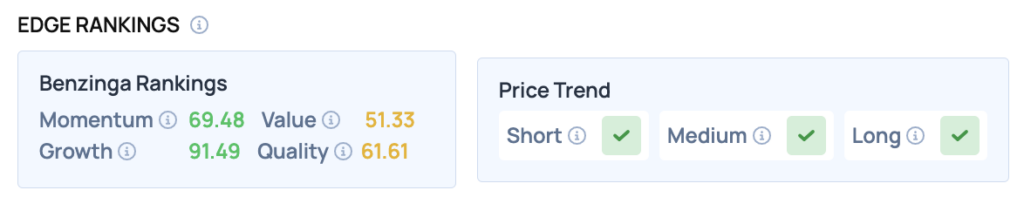

Price Action: According to data from?Benzinga Pro, AMZN shares are trading higher by 3.04% to $228.71. The stock has a 52-week high of $242.52 and a 52-week low of $161.43.

Read Also: Why Jackson Hole Is The Fed’s Mountaintop Moment?And Why It Matters More Than Ever

How To Buy AMZN Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Amazon.com’s case, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock

Print

Print