This Rare Signal Last Flashed In 1998?Then Stocks Took Off

BY Benzinga | CORPORATE | 08/18/25 03:20 PM EDTA rare bond market signal just re-emerged in mid-August 2025, one not seen since 1998 ? and back then, it was the calm before one of the most explosive bull markets in U.S. history.

- LQD is breaking past resistance. Check live prices here.

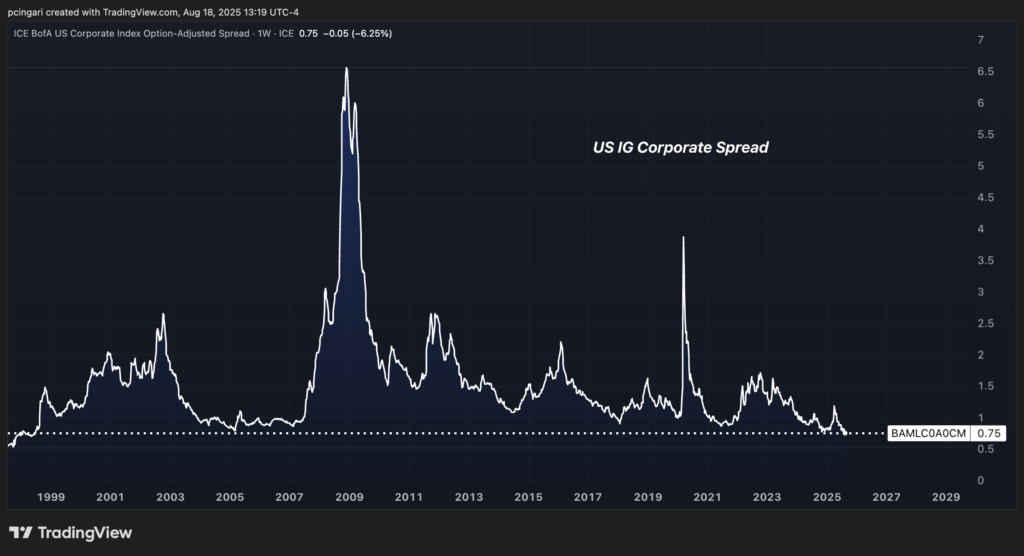

The spread between U.S. investment-grade corporate bonds and Treasury yields has collapsed to just 75 basis points, the lowest level since June 2008.

This means investors are demanding almost no additional compensation to buy corporate debt instead of risk-free U.S. Treasuries.

In plain terms, the bond market is showing extreme confidence in corporate America's ability to repay debt, and companies are taking full advantage.

No Extra Premium Needed?Wall Street Loves Corporate Debt Right Now

The investment-grade credit spread is a crucial barometer for financial conditions.

When it narrows, borrowing becomes cheaper for companies ? and that's exactly what's happening. Despite elevated interest rates, there's no almost risk premium being demanded from companies to borrow capital.

This surge in bond demand allows businesses to lock in financing without paying significantly more than what the U.S. government pays to finance its own debt.

Despite U.S. Treasury bonds posting losses this year ? with the iShares 20+ Year Treasury Bond ETF down 1.6% year-to-date ? investment-grade corporate credit ? as tracked by the iShares iBoxx $ Investment Grade Corporate ETF ? has climbed nearly 3% over the same period.

That's boosting corporate investment, balance sheet flexibility and potentially even shareholder returns.

<figure class="wp-block-image size-large"> </figure>

</figure>

Equity Rally Looks Narrow, Credit Rally Is Broad

Spencer Rogers, credit strategist at Goldman Sachs, highlighted that while equity valuations appear expensive and concentrated among a handful of names, the bond rally is more democratic.

"The impressive rally in equities has long been criticized for its narrow breadth," Rogers said in a note last week.

"In contrast, the rally in the USD IG credit market has been remarkably broad-based, with the median bond even outperforming the weighted-average index."

Over the past few months, the U.S. investment-grade index tightened by 17 basis points, pushing spreads toward historic lows. But unlike in stocks, where tech giants continue to dominate returns, the credit rally has lifted almost every corner of the bond market.

That broad participation is rare ? and powerful.

What Happens Next?

As long as recession risks stay low, Goldman Sachs believes corporate credit spreads could remain near current levels.

"Spread dispersion in the IG index has collapsed," Rogers said, meaning investors aren’t distinguishing much between different borrowers.

That's a sign of growing confidence in the overall health of the corporate sector ? not just its top performers.

While spreads this tight may seem risky, history suggests otherwise.

The last time investment-grade spreads collapsed like this ? in 1998 ? U.S. stocks entered a multi-year rally before the dot-com peak. Whether history repeats itself is anyone's guess, but the bond market just flashed a very bullish signal.

Read Next:

- Get Ready For A FOMO-Fueled Stock Market Melt-Up: Ed Yardeni

Image created using artificial intelligence via Midjourney.

Print

Print